What You Need to Know about Small Business Relief

The CARES Act specifically outlines the Paycheck Protection Program, a forgivable loan program that allows small businesses to get cash quickly and incentivizes them to not lay off employees.

Paycheck Protection Program

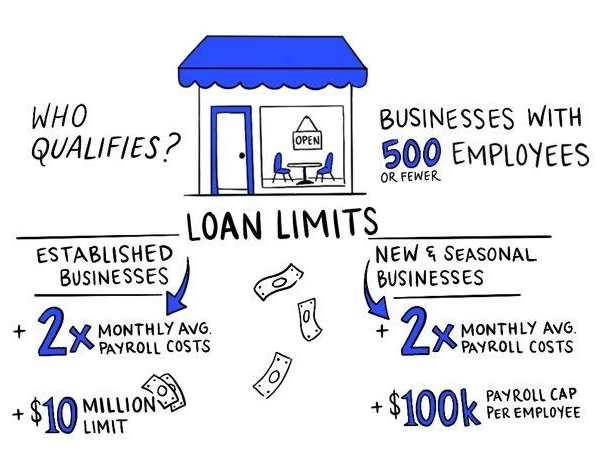

Who qualifies for a forgivable loan?

Businesses with 500 or fewer employees

How much are the loans for?

Loan amounts for established businesses:

- 2.5x monthly average payroll costs (based on payroll costs in 2019)

- $10 million limit

Loan amounts for new and seasonal businesses:

- 2.5x monthly average payroll costs (Based on whichever time period is applicable: March 1, 2019 – June 30, 2019 or Jan. 1, 2020 – Feb. 29, 2020)

- Payroll cost cap of $100,000 per employee (annualized)

What is the interest rate?

1% fixed rate

When can businesses apply?

April 3 for small businesses and sole proprietors

April 10 for self-employed individuals and independent contractors

How can businesses apply?

Businesses can apply through the following:

- Existing SBA lenders

- Federally insured banks

- Federally insured credit unions

- Farm Credit System institutions

What qualifications does a business have to meet for their loan to be forgiven?

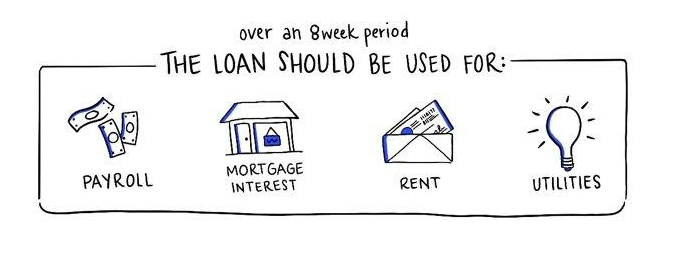

The loan should be used to pay for the following expenses over an 8 week period after receiving the loan:

- Payroll

- Mortgage interest

- Rent

- Utilities

Forgiveness is reduced if a business decreases full-time employee headcount or if they decrease wages by more than 25% for any employee who makes less than $100,000 in 2019.

When do businesses have to start paying loan interest?

Payments are deferred 6 months, but interest will accrue over that time.

When are these loans due?

In 2 years.

Quick facts for business taxes

- Refundable tax credit on 50% of worker wages paid between March 12, 2020 and Jan. 1, 2021 with a maximum amount of $10,000 in qualified wages per employee.

- Employers’ portions of payroll taxes for Social Security will be delayed until 2021 and 2022.

- Net operating loss rules under the Tax Cuts and Jobs Act have been modified. Losses for 2018, 2019, and 2020 can be carried back 5 years and the 80% rule is suspended until 2021.

Looking for more information about small business relief? Check out 5 Ways Businesses Can Maximize Cash Flow Under the CARES Act.